The world of cruise line stocks has been a fascinating space to watch, with companies like Carnival Corporation (CCL) making waves in the industry. As one of the largest cruise line operators globally, Carnival Corporation has been a popular choice among investors looking to capitalize on the growing demand for leisure travel. In this article, we'll delve into the world of Carnival Corporation common stock (CCL) and explore its real-time performance on the Nasdaq stock exchange.

Introduction to Carnival Corporation

Carnival Corporation is a leading global cruise line operator that owns and operates a fleet of cruise ships under several brands, including Carnival Cruise Line, Princess Cruises, Holland America Line, and Costa Cruises, among others. With a rich history dating back to 1972, the company has established itself as a pioneer in the cruise industry, offering a wide range of itineraries and onboard experiences to millions of passengers worldwide.

Carnival Corporation Common Stock (CCL) Overview

Carnival Corporation's common stock is listed on the Nasdaq stock exchange under the ticker symbol CCL. As a publicly traded company, CCL offers investors the opportunity to own a piece of the cruise line industry's largest player. The stock has been a popular choice among investors due to its relatively stable performance and dividend yield.

Real-Time Performance on Nasdaq

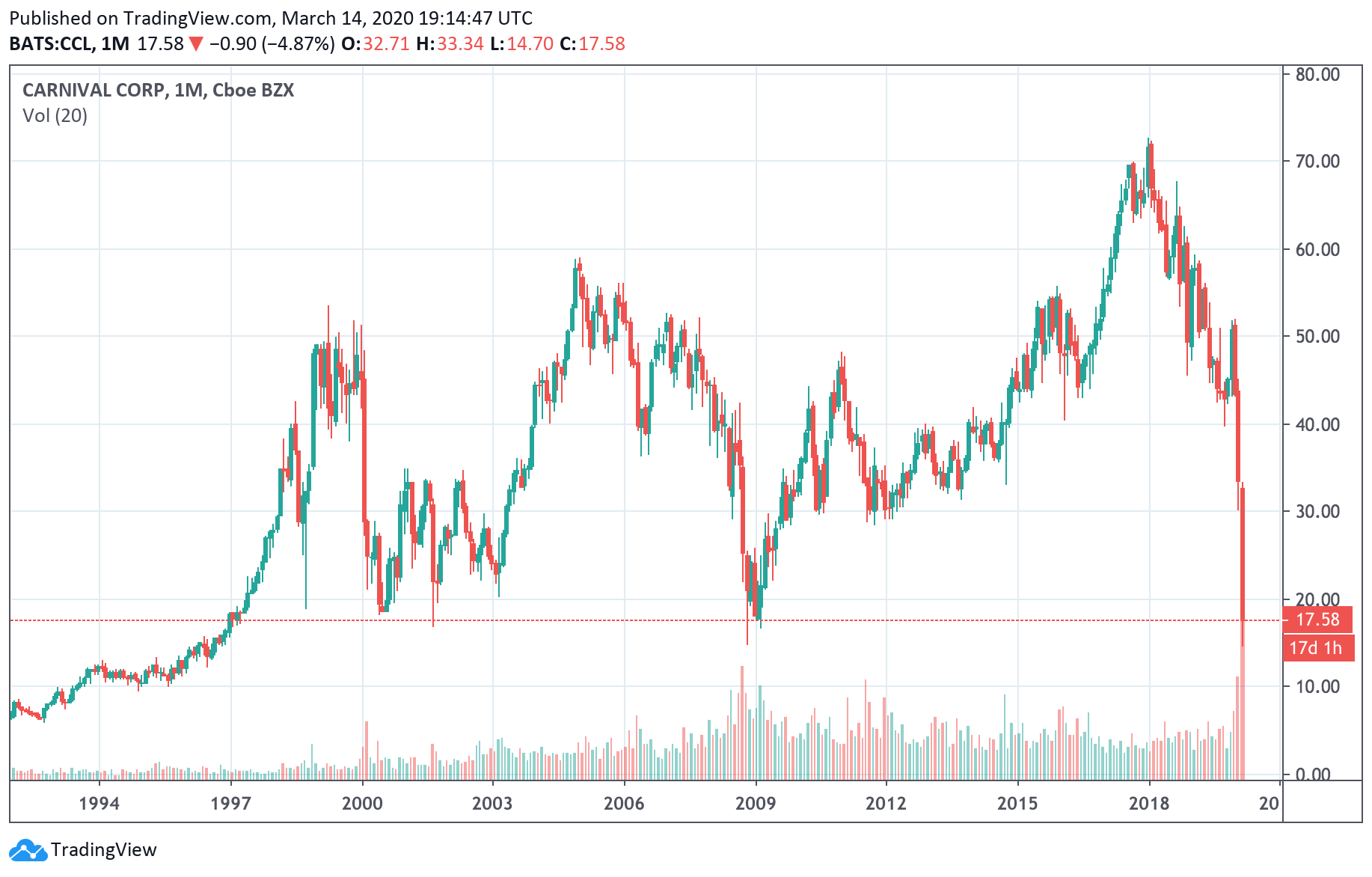

As of the latest update, Carnival Corporation's common stock (CCL) has been trading on the Nasdaq stock exchange with a market capitalization of over $20 billion. The stock has experienced a significant decline in recent years due to the COVID-19 pandemic, which had a devastating impact on the cruise industry. However, with the gradual reopening of borders and the resumption of cruise operations, CCL has shown signs of recovery.

In real-time, CCL's stock price has been fluctuating between $20 and $30 per share, with a 52-week range of $15.29 to $31.52. The stock's beta is approximately 2.1, indicating a higher level of volatility compared to the overall market.

Investment Prospects and Risks

Investing in Carnival Corporation common stock (CCL) offers both opportunities and risks. On the one hand, the company's diversified portfolio of brands and itineraries provides a stable source of revenue. Additionally, the growing demand for leisure travel and the increasing popularity of cruising as a vacation option bode well for the company's long-term prospects.

On the other hand, the cruise industry is highly sensitive to global events, such as pandemics, economic downturns, and geopolitical tensions. Furthermore, the company faces intense competition from other cruise line operators, which can impact its pricing power and market share.

Carnival Corporation common stock (CCL) is an attractive option for investors looking to tap into the growth potential of the cruise line industry. While the stock has faced challenges in recent years, its real-time performance on the Nasdaq stock exchange suggests a gradual recovery. As the industry continues to evolve and adapt to changing consumer preferences, CCL is well-positioned to capitalize on the growing demand for leisure travel. However, investors should be aware of the potential risks and volatility associated with the stock and conduct thorough research before making any investment decisions.

With its rich history, diversified portfolio, and commitment to innovation, Carnival Corporation is an exciting player in the world of cruise line stocks. Whether you're a seasoned investor or just starting to explore the world of stocks, CCL is definitely worth keeping an eye on.

Note: The information provided in this article is for general purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor or conduct your own research before making any investment decisions.